The increasing prevalence of technology has facilitated the process of financial management. You can borrow money immediately by using an advanced payment app like Dave. A cash advance is an alternative lender or bank-issued short-term loan. Many cash advance apps like Dave are available today. The majority of the best cash advance apps for Android and iOS provide you with functionalities similar to Dave and frequently with superior features in terms of cash availability. You have arrived at the correct page if looking for the best apps like Dave for cash advances. The best free cash advance smartphone apps are listed below. To commence, let us proceed.

How Do Cash Advance Apps Work?

Cash Advance apps closely resemble Buy Now Pay Later apps. You buy and pay for a product with Buy Now Pay Later. On the other hand, cash advances allow you to borrow money for emergencies and pay it back later. During emergencies, you could, for instance, borrow $100 from the Cash Advance app a few days before your payday. The cash advance app will promptly withhold the borrowed amount from your paycheck upon its arrival several days later.

Cash Advances and Personal Loans are distinct from one another. The Cash Advance apps don’t charge you interest because you use your money. However, cash advance apps typically charge $1–$10 monthly to use their services. Therefore, you must pay monthly fees ranging from $1 to $10 to use the cash advance features of these apps, which are otherwise free.

Top 14 Apps Like Dave To Get Cash Advances

You may be interested in learning about the apps that provide Cash Advance features now that you have learned about them. Here are some of the best apps, like Dave, for fast cash advances.

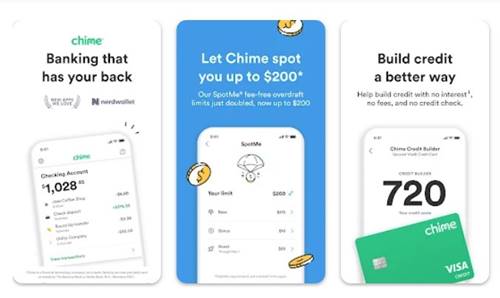

1. Chime

Financial technology firm Chime does not operate as a bank. Members of the FDIC and provider of banking services via The Bancorp Bank and Stride Bank, N.A. The app, which lets users manage their money through instantaneous transactions and daily balance notifications, is currently used by millions of users. In contrast to Dave, Chime does not provide cash advance services. Nevertheless, eligible users can claim up to $200 via SpotMe, a feature that permits accounts to be overdrawn by up to $200. However, the SpotMe amount is contingent on the repayment history of the user. Additionally, users can send money to family and acquaintances through Chime with no transfer fees.

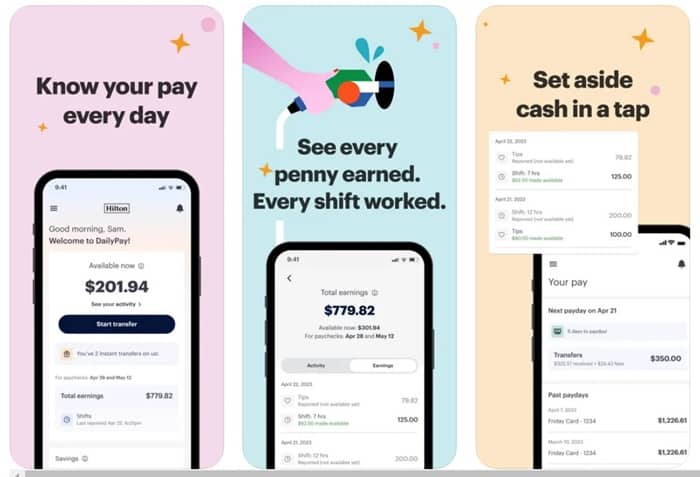

2. DailyPay On-Demand Pay

DailyPay On-Demand Pay, like every different cash advance app on the list, provides a secure method to access your accumulated wages before your payday. As usual, using this cash advance app, you can get your money when you need it. Unlike Dave, DailyPay’s functionality differs slightly from other apps on the list. By partnering with your employers, the organization enables you to borrow from your check early. The borrowed amount is repaid in full after the corresponding pay period.

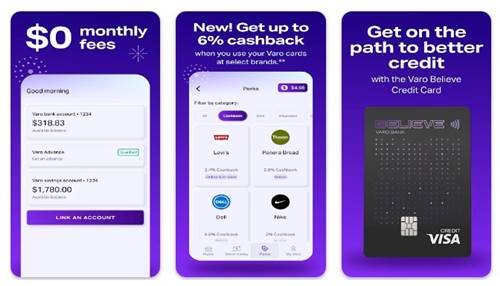

3. Varo

One of the best cash advance apps for mobile devices is Varo. This provides cash advance services comparable to the Dave app; however, eligibility requirements are quite stringent. A user must initially possess a valid account that has been used for at least thirty days. Second, you must complete a transaction totaling at least $1,000 within thirty days. A linked active Varo debit card to the bank is also required to qualify for the cash advance services. If your account meets the requirements, you can borrow up to $100 to cover unforeseen expenses. Additionally, Varo cards provide exceptional cashback offers on select brands.

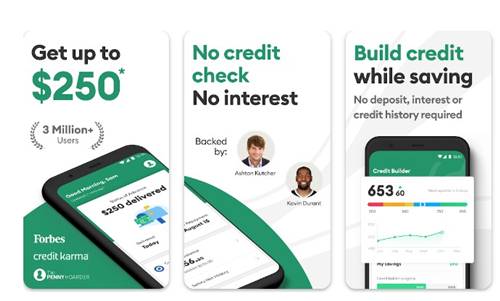

4. Earnin

Although Earnin is less well-known than Dave, it remains one of Android smartphone’s best cash advance apps. The service provides access to a maximum of $100 per day or $500 per paycheck. Earnin is an advantageous service in that it is entirely free; you are only required to pay a gratuity that you deem appropriate in recognition of the service that you receive. Earnin provides additional advantages like the Notification service, which alerts you when your account balance falls below a specified threshold, in addition to the cash advance and paycheck. Additionally, a cash-out function can immediately discharge up to $100 into your bank account, preventing overdraft fees. Earnin, like Dave, is an outstanding cash advance app.

5. Brigit

If you are seeking the most effective cash advance app to circumvent costly overdraft charges, Brigit might be your best option. Dave and Brigit are extremely similar in many ways. The service provides paycheck advances of $250 without imposing any interest charges on the borrower. But you must pay a $9.99 monthly membership fee, which is the problem. By paying the membership fees, you are also availed of other free features like account monitoring services and tools to examine your spending patterns. When the balance is low, Brigit deposits cash into your account automatically.

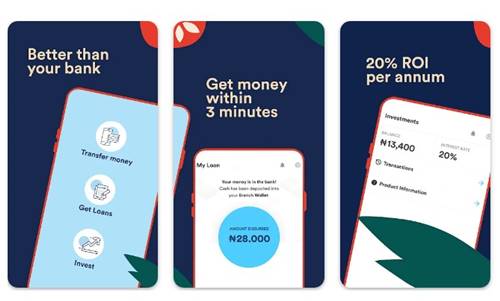

6. Branch- Personal Finance Loans

Branch-Personal Finance Loans could be the best option if you’re looking for an app that can provide the easiest and most secure way to borrow, save, and enhance your financial health from the convenience of your phone. Branch- Personal Finance Loans, like every other app on the list, provides a cash advance of up to $150 per day or a $500 deduction from your paycheck. The cash advance facilities, nevertheless, are subject to stringent requirements by the Branch. A salary account containing two salaries from the same employer is required initially. Additionally, a checking account and debit card must be maintained at the supported bank. Third, its services are not accessible to remote employees at the Branch.

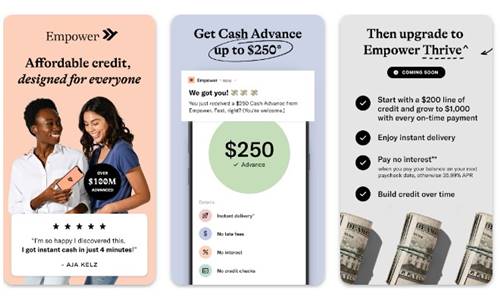

7. Empower

The best app, like Dave Cash Advance, that provides Instant Cash Advance features is Empower. You can obtain a $250 cash advance through Empower when you require it the most. One advantage of Empower is its absence of credit checks and late payment fees. An approximately $8 monthly membership plan is all that is required. Early Paycheck Deposit is an additional feature of Empower that grants users early access to their paychecks by a maximum of two days. In general, Empower is a great Dave substitute you can use today.

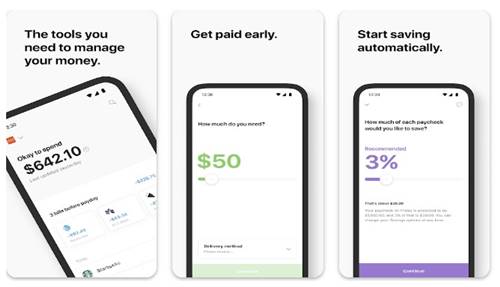

8. Even

Even the app provides the necessary tools for money management. It also lets you get paid early, like every other app on the list. To use it, however, employees must create an account with Even. Employees may borrow up to 50% of their unpaid salaries for a specified pay period after establishing the open account. You must pay the monthly membership fee; there are no transaction fees. Additionally, the Even app is advantageous due to its InstaPay functionality, which enables currency deposits into a bank account within one business day through more than 18,000 institutions.

9. SoFi

SoFi is a comprehensive app for financial management. Obtaining, saving, investing, borrowing, spending, and earning money is the purpose of this one. This differs slightly from most other apps like the ones Dave described in the article. Cash advance services are provided via the SoFi credit card. Furthermore, the credit limit is substantially elevated as it is the bank. A maximum cash advance limit of $1,000 per day is available through SoFi, with a minimum availability requirement. However, credit card ownership is required to use SoFi’s services.

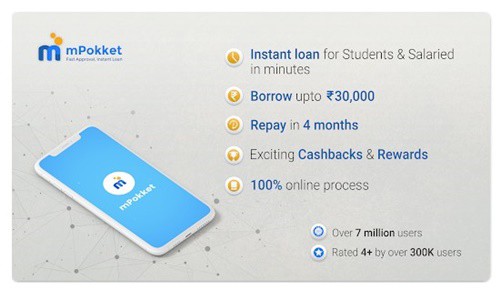

10. mPokket

Unlike the other apps on the list, like Dave, mPokket is somewhat unique. While not a cash advance app, it can facilitate access to Instant Personal Loans with reasonable interest rates. Registering for the app and obtaining an immediate personal loan is simple. The app transfers the funds directly to the linked bank account following approval. We have included mPokket on this list due to its adaptable repayment alternatives. Additionally, punctual repayment is rewarded within the app, and the processing and loan management fees are minimal.

Download: Android

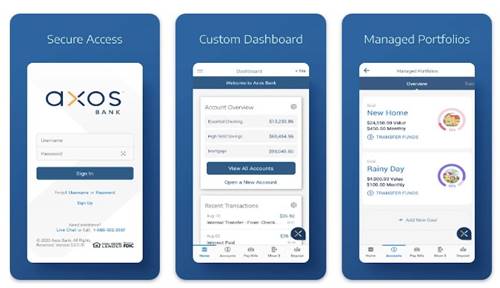

11. Axos Bank

About features, Axos Bank’s early paycheck app is likely the best and most comparable to Dave’s. The digital banking service in question provides checking and savings accounts. Numerous investment options, loans, and personal finance management tools are available through Axos. Use the Direct Deposit Express feature, which allows you to access the money early to get your money up to two days earlier. Axos Bank is also an authority on various other bank-related features, including check deposits, bill pay in advance, money transfers, and more.

12. Klover

Like Dave on the list, Klover is a fantastic app for immediate financial advances. Although payday is in two weeks, the app claims to be able to provide a cash advance of up to $200. We like that Klover uses a point-based system where you can accumulate points by watching advertisements and completing surveys. After amassing many points, one may exchange them for a more substantial advance. You can use Klover’s budgeting tools to establish savings objectives, monitor your credit score, earn bonus points upon goal achievement, and more.

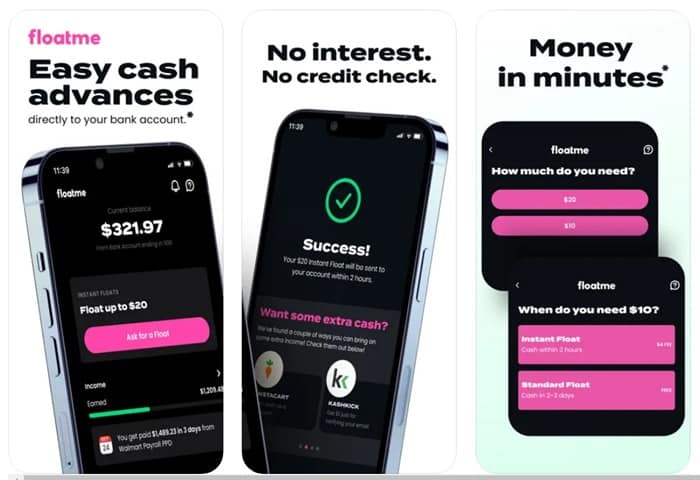

13. FloatMe

If you desire a straightforward, simple cash advance deposited directly into your bank account, FloatMe is an app worth evaluating. A FloatMe membership is available for $2.99 per month. We liked that FloatMe does not require credit checks, interest, or concealed fees. You can pay expenses, buy supplies, and more after receiving the cash advances. Membership is required to request financial advances, and approval of your request is not guaranteed, just like all the other apps like Dave mentioned in the article.

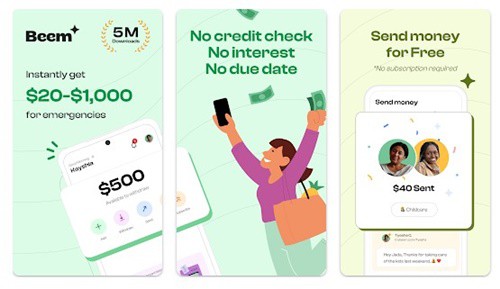

14. Beem

The highest-rated immediate cash advance app on the list is Beem. Its services are available in more than 5,200 communities. Beem’s cash advance allows you to obtain $20 to $1,000 of the intended funds, which you can deposit into your Been Wallet. Additionally, Beem’s Plus and Pro tiers grant access to the immediate payment feature. It lets you file federal and state taxes in any region for free, in addition to the cash advance. It is, therefore, a comprehensive app that enables you to manage your finances and improve your credit score.

Also, Check:

Conclusion:

Dave mentioned downloading and installing apps from the corresponding app stores. These are some of the best apps, like Dave, to obtain cash advances instantaneously and swiftly. In the comments section below, please let us know if you have any recommendations for apps like Dave.