There has been a rapid increase in the number of people using banking services, making it a daunting task to serve them properly. As a result, software suppliers have integrated Banking CRM Software tools that facilitates individualized customer service, enhancing client connections and satisfaction.

CRM has become a vital component of banking infrastructure for client management. However, a wide variety of CRM software for banking industry is available. This article discusses the leading 10 Banking CRM Software in 2022.

[lwptoc]What is CRM in Banking?

Customer Relationship Management (CRM) in the banking industry facilitates the management of a bank’s relationship with existing and prospective clients by collecting data, integrating communication channels, and streamlining customer service.

Banking CRM Software enables banks to collect, store, analyze, and use essential data to acquire and retain high-value, loyal clients.

Importance of CRM in the Banking Industry

CRM is vital for businesses with a large number of customers or clients. Nevertheless, CRM is essential in fully customer-dependent companies, such as banking. The importance of CRM in the banking sector is shown below.

- Record and manage consumer data, interactions, and conversations across several channels.

- It gives banks a 360-degree view of their customers, allowing them to comprehend their demands better.

- Allows the customer service team to provide more personalized service to clients.

- Provides a deeper understanding of customer demographics, purchasing trends, and data for improved policies.

- Identify and retain customers with a high lifetime value.

- Permits teams to gather information for customized marketing campaigns.

In conclusion, a solid CRM system can assist banks in enhancing customer happiness and loyalty, expanding cross-selling and upselling opportunities, and increasing productivity.

Benefits of CRM in Banking Industry

Here are the major advantages of best CRM for Financial Services industry:

Streamlines Entire Operations: Streamlines and automates a bank’s complete customer service and management business. Integrated workflows connect marketing, sales, and customer service seamlessly.

Improves Customer Loyalty and Satisfaction: Provides a 360-degree view of customers and enables banks to give individualized service to increase customer satisfaction.

Increases Efficiency: Increases productivity by automating repetitive processes and enhancing departmental communication.

Smooth Workflows: Establishes workflows between departments, resulting in enhanced communication and increased productivity.

Boosts Revenue: Provides enhanced customer insights for more revenue-generating products, services, promotions, and policies.

Improves Decision Making: Offers a plethora of structured client data that enables banks to make more informed marketing, sales, and customer service decisions.

Viable Reports and Analytics: Generates precise and understandable reports and analytics for setting objectives, finding gaps, and tracking progress.

10 Best CRM to Overcome Challenges in Banking Industry

Our specialists have examined and reviewed hundreds of CRM software for Banks and compiled a list of the best CRM for Banking Industry in 2022.

1. Salesforce CRM

Lets talk about the best Banking CRM Software Companies That Dominate in 2022. Salesforce CRM is one of the best market’s most popular CRMs. It features comprehensive integrations, industry-specific modules, and a highly scalable CRM solution, making it one of the top CRM solutions for the banking industry. In addition, it enables banks to provide a user experience centered on the consumer.

Salesforce CRM for Bank Features

- Industry-specific tailored remedy.

- Process automation.

- Opportunity administration.

- Projection and sales pipeline management.

- Omnichannel lead management.

- Social media intelligence gathering.

- Intelligent automation.

2. LeadSquared

It is a premier CRM solution that enables banks to manage the complete customer lifetime. If we talk about the top-rated Banking CRM Software, LeadSquared CRM for banks reduces ownership and customer acquisition expenses by improving the process of customer acquisition, onboarding, and engagement.

LeadSquared Features:

- Workflow modification.

- Enterprise-class security and management.

- Multi-channel engagement Mobile CRM for bank agents.

- Cross-sell/upsell engine.

- Recovery of debts module.

- Corporate banking management.

3. EngageBay

Next in our list of the best Banking CRM Software is EngageBay CRM. It is a complete CRM software that includes various customer management, sales, and marketing functions, making it an almost ideal CRM system for banks. For banks and insurance firms, distinguishing features such as behavior tracking and appointment scheduling are precious.

EngageBay Features

- 360-degree client perspective.

- Automatic scoring of leads.

- Centralized data sourcing.

- Revenue Gamification.

- Integrated interaction administration.

- Social media data extraction.

- Consistent information and interplay.

- Pipeline visualization.

4. HubSpot CRM

HubSpot CRM is a popular CRM solution that provides banks with various features for managing client connections. This Banking CRM Software is intended to provide a comprehensive customer view, from initial contact through post-purchase follow-ups. In addition to its complete integration and plugins, HubSpot is a popular option for banks.

HubSpot CRM Features:

- Complete client record tracking.

- Lead scoring and administration.

- Configurable processes.

- Email and social media scheduling automation.

- Enrichment and segmentation of data.

- Comprehensive reporting and analytics.

5. Zoho CRM

For a good reason, Zoho CRM is one of the most popular Banking CRM Software or solutions on the market. It is feature-rich, offers broad integrations, and can be used both in the cloud and on-premises, making it a versatile CRM system. This customer relationship management in banking sector also provides a Canvas and Developer platform that enables banks to customize the CRM to meet their requirements.

Zoho CRM for Bank Features

- Intelligent sales with conversational AI.

- Interaction with customers across all channels Intelligent alerting system.

- Email and call prioritization.

- Multiple pipeline management.

- Plan and validation guidelines.

- Mobile MDM & SDK.

6. Freshsales

It is an additional, comprehensive banking CRM solution that increases efficiency by streamlining and integrating the bank’s sales and marketing activities. Freshsales banking CRM has many integrations and plugins, making it flexible best CRM software.

Freshsales Features:

- AI-powered chatbots and business intelligence.

- Fully adaptable web forms.

- Visitor purpose monitoring.

- Contact prediction scoring.

- Slack augmentation.

- Dynamic foresight.

- Automated marketing effort.

- Staging the life cycle of a contract.

7. automateCRM

This best Banking CRM Software is an all-inclusive cloud-based CRM software banking sector with open-source integration and complete customization. In addition, the VI Data Studio facilitates the production of critical analytics and reports for predictive analysis and marketing optimization.

AutomateCRM Features:

- Automation of service and support.

- Affiliates administration.

- Project management.

- Drip marketing campaigns.

- Message scanners.

- Pipeline management and automation.

8. Nafhaa CRM

If we talk about the top-notch Banking CRM Software tools, Nafhaa CRM by Silicon IT is a user-centric CRM solution emphasizing customization and usability. Beyond simple customer management, Nafhaa also integrates marketing, customer service, and supply chain management.

Nafhaa CRM features

- Sales engagement tracking.

- CXO dashboard.

- Third-party software integration and API.

- IPBX device engagement.

- 50+ Integrations.

- User hierarchy for data segregation.

9. Oracle NetSuite CRM

If we talk about the best Financial Services CRM Software 2022, Oracle NetSuite is a robust Bank CRM system that enables banks and other financial institutions to create a tailored brand experience. This top Banking CRM Software also provides a vast array of features to assist banks in managing their customer connections, such as lead management, opportunity management, and partner relationship management.

Oracle NetSuite Features:

- Salesforce automation.

- Detailed reporting and analytics.

- Quota management.

- Partner relationship administration.

- Customer service administration.

- Modules specific to an industry.

- Compliance management.

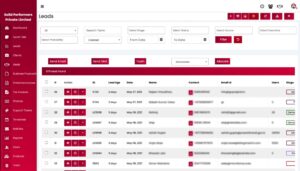

10. Solid Performers CRM

Are you still seeking the best Banking CRM Software in 2022? The Solid Performers CRM is an excellent option for banks seeking comprehensive, cost-effective, and user-friendly CRM software. Due to features such as Document Management, PI management, and deal management, it is an exceptional CRM for financial organizations.

ALSO SEE: Best Flipbook Software

It also provides advanced reporting and analytics features, making it an excellent option for developing institutions that want to track performance and close more leads.

Solid Performers CRM Features:

- Generation of leads using a chatbot.

- Ticket management module.

- Campaign and invoice administration.

- WebForm builder.

- API and third-party integration.

- Document management.

- Personalized dashboards.

- Campaign management.

FAQ

What CRM do banks use?

The Banking CRM Software options accessible to banks and other financial institutions are diverse. Freshsales, LeadSquared, Solid Performers CRM, and AutomateCRM are some of the most prominent CRMs used by banks.

How CRM is a valuable tool in the banking sector?

Banking CRM Software is a versatile tool for managing customer information, tracking customer interactions, and providing reports and analytics. Moreover, it automates sales and marketing operations, expedites communications, and enhances customer service.

Do banks use Salesforce?

Salesforce is one of banks’ most widely used CRM software platforms. It delivers features and capabilities that are specifically tailored to the banking industry’s requirements.

How is Salesforce used in the banking industry?

Salesforce is used in the banking sector for a variety of functions. It is used, for instance, to store customer data, track customer interactions, provide reports and analytics, automate sales and marketing operations, expedite communications, and enhance customer service.

Which is the highest-rated CRM in banking?

LeadSquared is one of the most well-regarded Financial Services CRM Systems 2022. It provides a complete set of banking-specific features, such as borrower and corporate relationship management, making it an excellent option for banks.